EY Law LLP is a Canadian law firm, affiliated with Ernst & Young LLP in Canada. Both EY Law LLP and Ernst & Young LLP are Ontario limited liability partnerships. For more information about the global EY organization please visit www.ey.com.

Tax Alert 2022 No. 18, 24 March 2022

“Saskatchewan’s economy and finances are back on track.

Our province has a vastly improved financial picture, and a solid plan to return to balance.”

Saskatchewan Finance Minister Donna Harpauer

2022–23 budget speech

On 23 March 2022, Saskatchewan Finance Minister Donna Harpauer tabled the province’s fiscal 2022–23 budget. The budget contains several tax measures affecting individuals and corporations.

The minister anticipates a deficit of $463 million for 2022–23 and projects smaller deficits for each of the next three years.

Following is a brief summary of the key tax measures.

Business tax measures

Corporate income tax rates

No changes are proposed to corporate income tax rates or the $600,000 small-business limit.

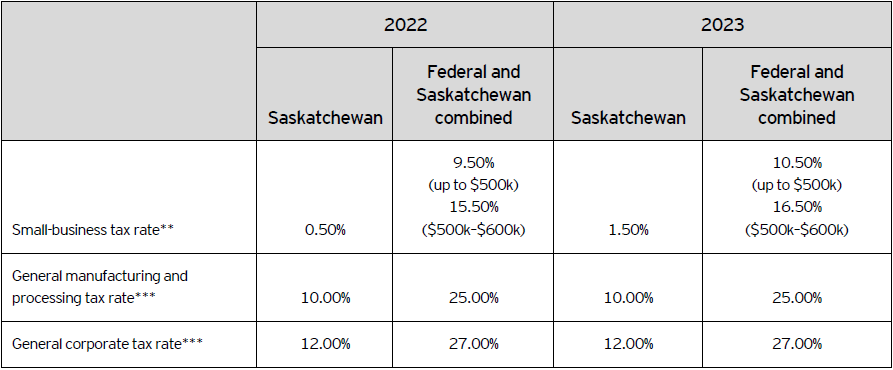

Saskatchewan’s 2022 and 2023 corporate income tax rates are summarized in Table A.

Table A – 2022 and 2023 corporate income tax rates*

* Rates represent calendar-year rates.

** Saskatchewan is temporarily reducing its small-business rate from 2.00% to nil effective for the period commencing 1 October 2020 and ending on 30 June 2022. The small-business rate will increase to 1.00% effective 1 July 2022 and return to a rate of 2.00% on 1 July 2023.

*** The 2021 federal budget proposed to temporarily reduce the federal corporate income tax rate for qualifying zero-emission technology manufacturers by 50% (i.e., to 7.5% for eligible income otherwise subject to the 15% general corporate income tax rate or 4.5% for eligible income otherwise subject to the 9% small-business corporate income tax rate), applicable for taxation years beginning after 2021. The reduced tax rates are proposed to be gradually phased out for taxation years beginning in 2029 and fully phased out for taxation years beginning after 2031.

Other business tax measures

Saskatchewan Value-added Agriculture Incentive

The budget proposes to enhance the Saskatchewan Value-added Agriculture Incentive tax credit rates to 15% on projects up to $400 million, 30% on the portion between $400 and $600 million, and 40% on the portion in excess of $600 million. This change is effective retroactively to the origin of the program in 2018. The dollar value of the tax credit will be capped at $250 million.

Saskatchewan Technology Start-up Incentive

The budget proposes an enhancement of the Saskatchewan Technology Start-up Incentive by increasing the non-refundable income tax credit cap from $2.5 million to $3.5 million, effective on 1 April 2022.

Personal tax

Personal income tax rates

The budget does not include any changes to personal income tax rates.

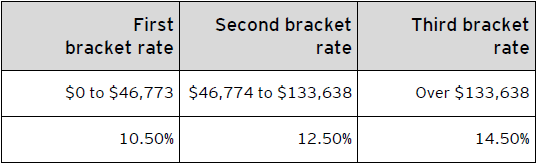

The 2022 Saskatchewan personal income tax rates are summarized in Table B.

Table B – 2022 Saskatchewan personal income tax rates

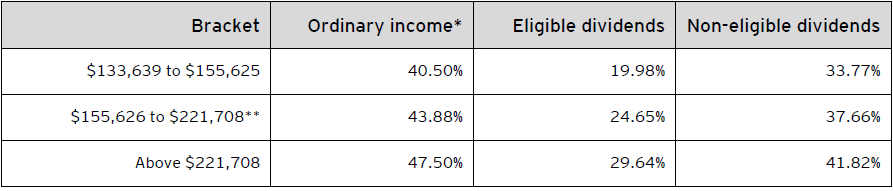

For taxable income in excess of $133,638, the 2022 combined federal-Saskatchewan personal income tax rates are outlined in Table C.

Table C – Combined 2022 federal and Saskatchewan personal income tax rates

* The rate on capital gains is one-half the ordinary income tax rate.

** The federal basic personal amount comprises two elements: the base amount ($12,719 for 2022) and an additional amount ($1,679 for 2022). The additional amount is reduced for individuals with net income in excess of $155,625 and is fully eliminated for individuals with net income in excess of $221,708. Consequently, the additional amount is clawed back on net income in excess of $155,625 until the additional tax credit of $252 is eliminated; this results in additional federal income tax (e.g., 0.38% on ordinary income) on net income between $155,626 and $221,708.

Other tax measures

Provincial Sales Tax

The budget proposes the following changes to Provincial Sales Tax (PST):

- The PST base will be expanded to include admission and entertainment charges, following the federal Goods and Services Tax treatment, effective 1 October 2022. There will be exemptions for certain situations, however, including events that are put on by a public sector body and do not feature paid participants, fees for recreational programs provided to those 14 years of age and under, and fundraising events.

- The sale of audiobooks will be exempt from PST, effective 1 April 2022.

Tobacco product taxation

The budget proposes an increase to the Tobacco Tax rate from 27¢ to 29¢ on cigarette sticks, from 27¢ to 35¢ per gram of loose tobacco, and from 20.5¢ to 21.8¢ on heat-not-burn sticks, effective on 24 March 2022.

Vapour product taxation

The budget expands the Lloydminster Provincial Sales Tax Exemption Regulations by adding Vapour Products Tax to the list of tax-exempt purchases within the city of Lloydminster, effective 24 March 2022.

Property tax

The budget introduces a slight increase to the current Education Property Tax mill rates.

Carbon taxation

The budget announces that the Government of Saskatchewan will begin the process of developing a proposal to take over administration of, and all revenues from, the federal carbon tax backstop fuel charge.

Learn more

For more information, please contact your EY or EY Law advisor or one of the following professionals:

Ryan Ball

+1 306 649 8225 | ryan.ball@ca.ey.com

Craig Hermann

+1 306 649 8204 | craig.hermann@ca.ey.com

Wes Unger

+1 306 649 8247 | wes.unger@ca.ey.com

Luke Hergott

+1 306 649 8251 | luke.hergott@ca.ey.com

Download this tax alert

Budget information: For up-to-date information on the federal, provincial and territorial budgets, visit ey.com/ca/Budget.