EY Law LLP is a Canadian law firm, affiliated with Ernst & Young LLP in Canada. Both EY Law LLP and Ernst & Young LLP are Ontario limited liability partnerships. For more information about the global EY organization please visit www.ey.com.

Tax Alert 2021 No. 35, 14 December 2021

“With winter upon us, we know that there may still be some tempests ahead. But we are resilient. Our plan is working. And, as we finish the fight against COVID-19, we will turn our resolve towards fighting climate change, advancing reconciliation with Indigenous peoples, and building an economy that is stronger, fairer, more competitive, and more prosperous.”

Deputy Prime Minister and Finance Minister Chrystia Freeland

Economic and Fiscal Update 2021

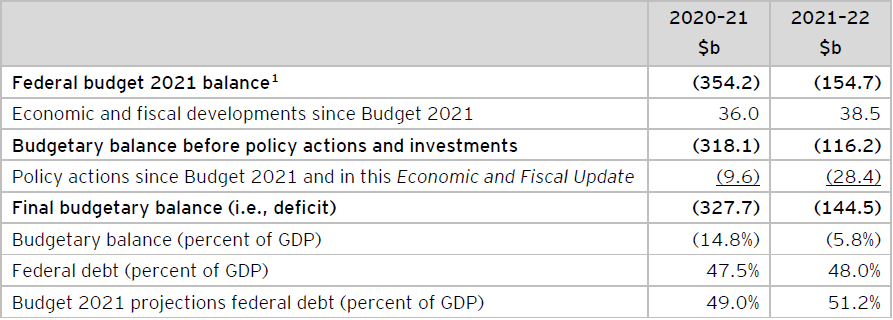

On 14 December 2021, federal Deputy Prime Minister and Finance Minister Chrystia Freeland tabled the federal government’s Economic and Fiscal Update 2021. The Economic and Fiscal Update 2021 (EFU) contains several tax measures affecting individuals and corporations. As set out in Table A, the minister anticipates a deficit of $144.5b for 2021–22 and projects deficits for each of the next five years.

Table A: Projections of federal budgetary deficit

Numbers may not add due to rounding.

1 The 2021 federal budget was delivered on 19 April 2021. See EY Tax Alert 2021 Issue No. 19.

Business income tax measures

The following is a summary of the business support measures announced:

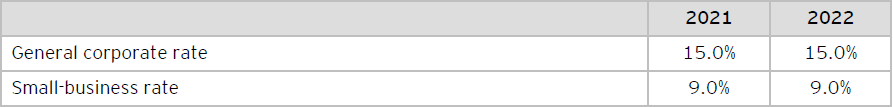

Corporate tax rates

No changes are proposed to the corporate income tax rates or to the $500,000 small-business income limit of a Canadian-controlled private corporation (CCPC). The enacted Canadian federal corporate income tax rates are summarized in Table B.

Table B: Federal corporate income tax rates*

* In the 2021 federal budget, tabled on 19 April 2021, the government proposed to reduce the corporate income tax rate for zero-emission technology manufacturers, to 7.5% for eligible income otherwise subject to the 15% general corporate income tax rate or 4.5% for eligible income otherwise subject to the 9% small-business corporate income tax rate, applicable for taxation years beginning after 2021. The reduced tax rates will be gradually phased out beginning in 2029 and fully phased out for taxation years beginning after 2031. To date, legislative amendments to implement this proposal have not been released.

Digital Services Tax

As announced on 8 October 2021, the government is moving ahead with Digital Services Tax (DST) legislation. The DST would apply at a rate of 3% on revenue earned by large businesses from certain digital services that rely on data and content contributions from Canadian users. However, consistent with a new international agreement under the auspices of the Organisation for Economic Co-operation and Development, the tax will apply only as of 1 January 2024, and only if the treaty implementing a new multilateral tax regime has not come into force (which was endorsed by G20 Finance Ministers and Leaders). In that event, the DST would be payable as of 2024 in respect of revenues earned as of 1 January 2022. A notice of ways and means motion (NWMM) to implement the DST was also tabled with the EFU.

A more detailed tax alert will follow on this matter.

Other business tax measures

The minister also proposed two business income tax measures, which have been included in the accompanying NWMM tabled with the EFU:

- Small businesses air quality improvement tax credit – Introduction of a temporary 25% refundable tax credit to encourage small businesses to invest in better ventilation and air filtration to improve indoor air quality.

Eligible entities (e.g., unincorporated sole proprietors and CCPCs with taxable capital employed in Canada of less than $15 million in the preceding taxation year) will be limited to a maximum of $10,000 in qualifying expenditures per qualifying location and a maximum of $50,000 across all qualifying locations incurred between 1 September 2021 and 31 December 2022. These limits will be shared among affiliated entities.

Qualified expenditures will include expenses directly attributable to the purchase, installation, upgrade or conversion of mechanical heating, ventilation and air conditioning systems, and the purchase of standalone devices designed to filter air using high-efficiency particulate air filters.

- Return of fuel charge proceeds directly to farmers – Introduction of a refundable tax credit as a means to return fuel charge proceeds under the federal carbon pollution pricing system directly to farming businesses in provinces that do not currently meet the federal stringency requirements (i.e., Ontario, Manitoba, Saskatchewan and Alberta) (referred to as “backstop jurisdictions”), beginning in the 2021–22 fuel charge year.

The amount of the tax credit will be equal to the eligible farming expenses attributable to backstop jurisdictions in the calendar year when the fuel charge year begins, multiplied by the payment rate as specified by the Minister of Finance for the fuel charge year per $1,000 in eligible farming expenses (i.e., $1.47 and $1.73 for 2021 and 2022, respectively).

Eligible farming businesses include corporations, individuals and trusts that actively engage in either the management of, or daily activities related to, the earning of income from farming and incur total farming expenses of $25,000 or more, which are all or partially attributable to backstop jurisdictions, including where the business is carried on through a partnership.

Eligible farming expenses include amounts that are deducted in computing income from farming for tax purposes but do not include deductions in respect of mandatory and optional inventory adjustments and non-arm’s length transactions.

The government also announced that it intends to return a portion of the proceeds from the price on pollution to small and medium-sized enterprises through new federal programming in backstop jurisdictions — further details will be announced in early 2022.

Tax measures for individuals and trusts

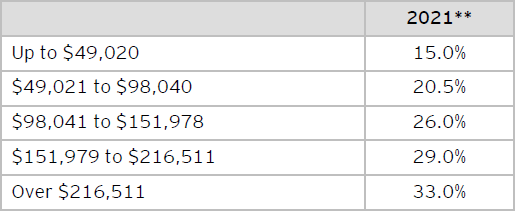

Personal income tax rates

There are no individual income tax rate or tax bracket changes in this EFU. The brackets will continue to be indexed for inflation.

See Table C for the 2021 federal rates.

Table C: Federal personal income tax rates

** For 2022, the rates will be the same, but the brackets will be $50,197, $100,392, $155,625 and $221,708, respectively.

Other personal tax measures

The EFU includes the following personal tax measures:

- Simplifying the home expense deduction – The 2021 EFU announced a two-year extension of the simplified flat-rate method for deducting home office expenses to include both the 2021 and 2022 taxation years. In addition, the maximum deductible amount will be increased from $400 in 2020 to $500 for 2021 and 2022.

The simplified flat-rate method was introduced for the 2020 taxation year to allow employees who worked from home due to the pandemic to claim up to $400 in home office expenses. The claim was based on the amount of time spent working from home (at $2 per day in 2020 to a maximum of 200 days), without the need to track detailed expenses. Employers were not required to complete and sign a Form T2200, Declaration of Conditions of Employment, in respect of employees using the flat-rate method for claiming home office expenses. The extension of the program is in recognition that many Canadians are continuing to work from home beyond 2020 due to the pandemic.

- Eligible educator school supply tax credit – The EFU proposes a number of changes that will enhance the refundable eligible educator school supply tax credit for 2021 and subsequent years, including:

- An increase in the tax credit rate from 15% to 25% on up to $1,000 of expenditures made in a taxation year for eligible supplies

- Elimination of the requirement that the teaching supplies must be used in a school or regulated child care facility to be eligible (i.e., this change broadens the locations where teaching supplies are permitted to be used and ensures, for example, that eligible supplies may be used in an online classroom environment beyond the context of the COVID-19 pandemic)

- Expanding the list of prescribed durable goods that qualify as eligible supplies to include certain electronic devices, such as calculators, external data storage devices, web cams, microphones and headphones, speakers, printers, video streaming devices and multimedia projectors, as well as laptop, desktop and tablet computers if not made available to the eligible educator by their employer for use outside of the classroom

An eligible educator making a claim may, at the request of the Minister of National Revenue, be required to provide a certificate from their employer attesting to the eligible supplies, and for 2021 and subsequent years, this will include attesting to the fact that the additional conditions in respect of laptops, desktops and tablet computers are met. These changes are included in the accompanying NWMM that was tabled with the EFU.

- Assistance in respect of COVID-19-related measures – The EFU announced a one-time payment that will be provided to assist low-income seniors who may have experienced a partial or full clawback of their Guaranteed Income Supplement (GIS) or related Allowance payments due to the receipt of either Canada Emergency Response Benefits (CERB) or Canada Recovery Benefits in 2020. The receipt of COVID-19-related benefits, which are taxable and included in a recipient’s income for tax purposes, resulted in the clawback of GIS and Allowance benefits of many recipients since these are income-tested benefits.

In addition, the government is proposing to provide debt relief to students who received, but were ineligible for, CERB benefits, but were eligible for the Canada Emergency Student Benefit (CESB) COVID-19 relief program in 2020. A student’s CERB-related debt, arising from the requirement to repay ineligible CERB benefits, will be allowed to be offset by the amount they would have received from the CESB during the same benefit period.

Sales and excise tax

Also, several indirect tax measures are proposed in the EFU, including measures with respect to:

- Underused Housing Tax – Budget 2021 announced the government’s intention to implement a national, annual 1% tax on the value of nonresident, non-Canadian-owned residential real estate in Canada that is considered to be vacant or underused (the Underused Housing Tax). The government has proposed that the tax be effective for the 2022 calendar year. Therefore, the initial Underused Housing Tax returns, for the 2022 calendar year, would be required to be filed on or before 30 April 2023.

Exemptions to the Underused Housing Tax have been proposed by the government. Notably, an owner’s interest in a residential property would be exempt from the Underused Housing Tax for a calendar year if a residence that is part of the residential property is the primary place of residence of (1) the owner; (2) the owner’s spouse or common-law partner; or (3) an individual that is the child of the owner or of the owner’s spouse or common-law partner, but only if the child is in Canada for the purposes of authorized study and the occupancy relates to that purpose.

Furthermore, an owner’s interest in a residential property would be exempt from the Underused Housing Tax for a calendar year if the property (1) is located in an area of Canada that is not an urban area within either a census metropolitan area or a census agglomeration having 30,000 or more residents; and (2) is personally used by the owner (or the owner’s spouse or common-law partner) for at least four weeks in the calendar year.

An owner eligible for either of the above exemptions would claim the exemption in the annual return that they would be required to file in respect of the residential property.

This proposed tax is included in the accompanying NWMM that was tabled with the EFU.

- Luxury tax – Budget 2021 proposed to introduce a tax on the sales, for personal use, of luxury cars and personal aircraft with a retail sales price over $100,000, and boats, for personal use, over $250,000. The Department of Finance has undertaken consultations with respect to the design of this measure and is working to incorporate the results of this consultation into the proposed tax framework. Draft legislation, including details on coming-into-force, will be released in early 2022.

Learn more

For more information, please contact your EY or EY Law advisor.

Download this tax alert

Budget information: For up-to-date information on the federal, provincial and territorial budgets, visit ey.com/ca/Budget.