EY Law LLP is a Canadian law firm, affiliated with Ernst & Young LLP in Canada. Both EY Law LLP and Ernst & Young LLP are Ontario limited liability partnerships. For more information about the global EY organization please visit www.ey.com.

Tax Alert 2021 No. 20, 21 April 2021

“Budget 2021 focuses on protecting people’s health and livelihoods through the pandemic, while making investments in services, infrastructure and opportunities to support a strong recovery and a brighter future for everyone.”

British Columbia Finance Minister Selina Robinson

2021 press release

On 20 April 2021, British Columbia Finance Minister Selina Robinson tabled the province’s 2021 budget. The budget contains no new taxes and no tax increases.

The minister anticipates a deficit of $9.7 billion for 2021–22 and projects deficits for each of the next two years.

Following is a brief summary of the key tax measures.

Business tax measures

Corporate tax rates

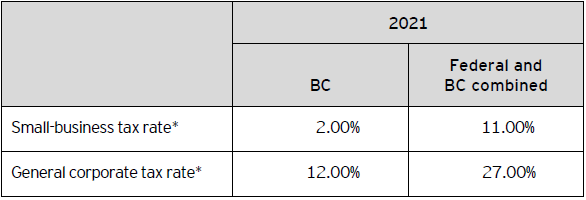

No changes are proposed to the corporate tax rates or the $500,000 small-business limit.

British Columbia’s 2021 corporate tax rates are summarized in Table A.

Table A – 2021 British Columbia corporate tax rates

* Rates represent calendar-year rates unless otherwise indicated.

Other business tax measures

Announced previously on 10 March 2021, the book publishing tax credit is extended for five years to 31 March 2026.

As previously announced, the mining flow-through share tax credit eligibility period during which an expenditure must be incurred by the issuer to be renounced in favour of flow-through shares is temporarily extended by 12 months, aligning with proposed temporary federal timelines.

The 12-month extension applies to flow-through share agreements entered into on or after 1 March 2018 and before 2021 when using the general rule. It also applies to agreements entered into in 2019 or 2020 when using the look-back rule.

Personal tax

Personal income tax rates

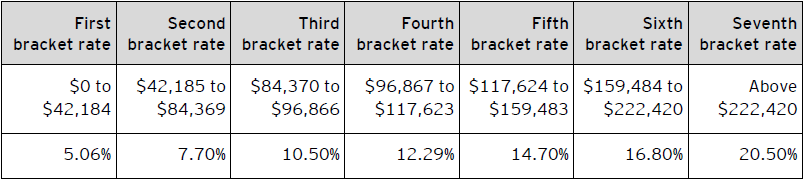

The budget does not include any changes to personal income tax rates.

The 2021 British Columbia personal tax rates are summarized in Table B.

Table B – 2021 British Columbia personal tax rates*

* Individuals resident in British Columbia on 31 December 2021 with taxable income up to $20,924 generally pay no provincial income tax as a result of a low-income tax reduction. The low-income tax reduction is clawed back on income in excess of $20,924 until the reduction is eliminated, resulting in an additional 3.56% of provincial tax on income between $20,925 and $34,929.

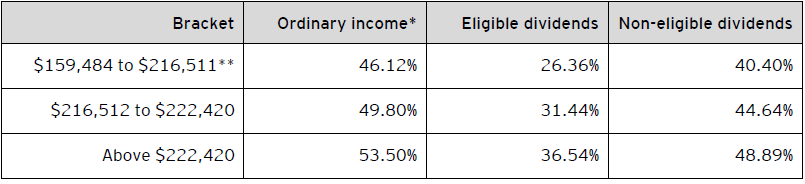

For taxable income in excess of $159,483, the 2021 combined federal-British Columbia personal income tax rates are outlined in Table C.

Table C – Combined 2021 federal and British Columbia personal tax rates

* The rate on capital gains is one-half the ordinary income tax rate.

** The federal basic personal amount comprises two elements: the base amount ($12,421 for 2021) and an additional amount ($1,387 for 2021). The additional amount is reduced for individuals with net income in excess of $151,978 and is fully eliminated for individuals with net income in excess of $216,511. Consequently, the additional amount is clawed back on net income in excess of $151,978 until the additional tax credit of $208 is eliminated; this results in additional federal income tax (e.g., 0.32% on ordinary income) on net income between $151,979 and $216,511.

Other personal tax measures

This budget included changes to the following personal credits/amounts:

- Effective 1 July 2021, the climate action tax credit rate remains at $174 per adult and $51 per child due to the delay in the carbon tax rate increase. Rates will increase to $193.50 per adult and $56.50 per child on 1 July 2022, in line with the corresponding carbon tax rate increase. This alters the timeline established by budget 2019 by one year.

- Budget 2021 also proposes to expand the eligibility for the Emergency Benefit for Workers to include self-employed individuals if they would have qualified for the Emergency Benefit for Workers or the Canada Emergency Response Benefit based on their gross income. This mirrors a federal change to the Canada Emergency Response Benefit.

Provincial sales tax

- Exemption for electric bicycles and tricycles introduced: Effective 21 April 2021, qualifying electric bicycles and tricycles, including conversion kits used to electrify conventional bicycles and tricycles, and parts and services for electric bicycles and tricycles are exempt from provincial sales tax (PST). To qualify, the electric bicycles or tricycles must have pedals or hand cranks that allow for human propulsion, wheels with a minimum diameter of 350 millimetres and maximum motor power of 500 watts. The maximum motor-assisted speed cannot exceed 32 kilometres per hour, and they must not have a combustion engine or be marketed or designed to have the appearance of a motorcycle, moped or scooter.

- Exemption for new residents’ effects temporarily expanded: The expanded timeframe is provided in response to COVID-19 travel restrictions and applies to any person who became a resident of BC on or after 11 March 2019. Individuals who would otherwise qualify for the exemption will now have until the earlier of 1 January 2023 or one year following the end of the most recent quarantine order made under the Quarantine Act (Canada) to bring their personal effects into BC. Under normal conditions, the personal effects of a new resident are generally exempt from PST if they are brought into BC within one year of the individual becoming a resident.

- Measures to address PST refunds on “grey market” vehicle transactions: Effective on a date to be set by regulation, the PST refund for motor vehicles purchased in BC and resold within seven days will be eliminated. This measure is intended to prevent certain “grey market” transactions whereby purchasers who intend to resell the vehicles, but do not state this intention to motor vehicle dealers who traditionally would not sell vehicles to resellers, buy and resell the vehicle and claim the PST refund. The announced changes would maintain the regular PST treatment of resale inventory but close the PST refund process to the type of “grey market” activity described in Peter German’s money laundering report.1

Other tax measures

Carbon tax

As announced on 2 September 2020, carbon tax rates are set at $45 per tonne of carbon dioxide equivalent emissions (CO2e) effective 1 April 2021. Rates will increase to $50 per tonne of CO2e on 1 April 2022.

This alters the schedule established by Budget 2017 Update, which would have increased carbon tax rates to $45 and $50 per tonne of CO2e on 1 April 2020 and 1 April 2021, respectively.

The corresponding increase to the climate action tax credit is also delayed by one year.

Tobacco tax

Effective 1 July 2021, the tax rate on cigarettes is increased to 32.5 cents from 29.5 cents per cigarette (to $65 from $59 per carton of 200 cigarettes). The default tax on heated tobacco products is also increased to 32.5 cents from 29.5 cents per heated tobacco product. A heated tobacco product is a product that contains tobacco and is designed to be heated, but not combusted, in a tobacco heating unit to produce a vapour for inhalation.

Also, effective 1 July 2021, the tax rate on loose tobacco (tobacco in a form other than cigarettes, cigars or heated tobacco products) is increased to 65 cents from 39.5 cents per gram. This increase better aligns the tax on “roll-your-own” tobacco with the level of tax that applies to premade cigarettes.

Speculation and Vacancy Tax Act

- Exemption for corporations owned by agents of government introduced: An exemption from the speculation and vacancy tax is introduced for wholly owned subsidiaries of a government agent beginning in the 2021 tax year.

- Exemption for registered charities that hold property through a trustee introduced: Retroactive to 27 November 2018, a speculation and vacancy tax exemption is introduced for a person who owns the property as a trustee of a trust for the benefit of a registered charity.

- Definition of beneficial owner amended: Retroactive to 27 November 2018, the Speculation and Vacancy Tax Act is amended to not include a beneficial interest contingent on the death of another individual in the definition of “beneficial owners.”

Other technical amendments

Budget 2021 introduces a number of technical amendments to various tax acts including the Assessment Act, Employer Health Tax Act, Income Tax Act, Property Transfer Tax Act Provincial Sales Tax Act and Speculation and Vacancy Tax Act for clarity and certainty:

- Effective on Royal Assent, the Assessment Act is amended to:

- Allow BC Assessment to deliver notices electronically with taxpayer consent;

- Allow BC Assessment to make accessible through other online portals reports that are currently accessible only through BC Online; and

- Align with the terminology in the Vancouver Charter.

- The Income Tax Act is amended:

- Effective 13 March 2020, to extend the deadline to file tax credits to the earlier of 31 December 2020 and six months from the original filing deadline for the book publishing tax credit, film tax credits, interactive digital media tax credit, mining exploration tax credits, scientific research and experimental development tax credit and the training tax credits;

- Effective 25 March 2020, to ensure that federal COVID-19 response measures do not affect the operation of British Columbia income tax benefits and remittances of provincial income tax withholdings; and

- Effective 18 December 2020, to provide administrative provisions in respect of the British Columbia Recovery Benefit. The benefit is a refundable tax credit of up to $500 for an individual and up to $1,000 for a family.

- Effective 30 March 2021, the Employer Health Tax Act is amended to provide administrative provisions in respect of the Increased Employment Incentive. The incentive provides a 15% refundable tax credit for employers who created new jobs for BC workers or increased payroll for existing low- or middle-income employees over the last quarter (October to December) of 2020.

- Effective 20 April 2021, the Property Transfer Tax Act is amended to restrict a taxpayer’s choice of arbitration to disputes about the fair market value portion of an assessment.

- The Provincial Sales Tax Act is amended to:

- Effective 1 April 2021, clarify that the exemption for water does not apply to beverages taxed under the soda beverage measures announced in Budget 2020;

- Effective on Royal Assent and on a date to be specified by regulation, make minor changes in terminology to provisions related to multi-jurisdictional vehicles;

- Effective on Royal Assent, clarify that an agent is authorized to use the registration number of their principal when acting on their behalf; and

- Effective 1 April 2021, make minor clarifications to provisions related to registration thresholds for Canadian sellers of goods, along with Canadian and foreign sellers of software and telecommunication services.

- Effective on Royal Assent, the Speculation and Vacancy Tax Act is amended to:

- Update references to the Canada Revenue Agency (CRA) income tax return form to match the new CRA line numbers; and

- Effective 1 January 2022, clarify that the administrator can assess within the specified time period.

Learn more

For more information, please contact your EY or EY Law advisor or one of the following professionals:

Lokesh Chaudhry

+1 604 899 3532 | lokesh.chaudhry@ca.ey.com

Cristina Gutiu

+1 604 648 3648 | cristina.gutiu@ca.ey.com

Rodger So

+1 604 891 8210 | rodger.so@ca.ey.com

___________________________

1. https://icclr.org/publications/dirty-money-report-part-2/

Download this tax alert

Budget information: For up-to-date information on the federal, provincial and territorial budgets, visit ey.com/ca/Budget.