EY Law LLP is a Canadian law firm, affiliated with Ernst & Young LLP in Canada. Both EY Law LLP and Ernst & Young LLP are Ontario limited liability partnerships. For more information about the global EY organization please visit www.ey.com.

Tax Alert 2021 No. 16, 7 April 2021

“…Our government will manage carefully — without reckless cuts or large tax increases that would threaten both the pandemic response and a strong recovery.

…This budget protects, builds and grows Saskatchewan.

It charts a clear course for our province through the remainder of the pandemic and into the strong recovery that will follow.”

Saskatchewan Finance Minister Donna Harpauer

2021–22 budget speech

On 6 April 2021, Saskatchewan Finance Minister Donna Harpauer tabled the province’s fiscal 2021–22 budget. The budget contains several tax measures affecting individuals and corporations.

The minister anticipates a deficit of $2.6 billion for 2021–22 and projects deficits for each of the next three years.

Following is a brief summary of the key tax measures.

Business tax measures

Corporate tax rates

The budget confirms the temporary reduction of the small-business rate from 2.00% to nil, which commenced on 1 October 2020 and ends on 30 June 2022. No changes are proposed to the $600,000 small-business limit.

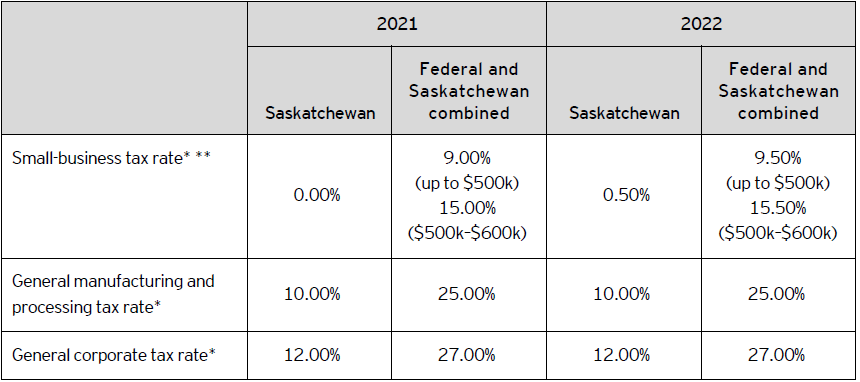

Saskatchewan’s 2021 and 2022 corporate tax rates are summarized in Table A.

Table A – 2021 and 2022 corporate tax rates

* Rates represent calendar-year rates unless otherwise indicated.

** Saskatchewan is temporarily reducing its small-business rate from 2.00% to nil, effective for the period commencing 1 October 2020 and ending on 30 June 2022. The small-business rate will increase to 1.00% effective 1 July 2022 and return to a rate of 2.00% on 1 July 2023.

Personal tax

Personal income tax rates

The budget does not include any changes to personal income tax rates.

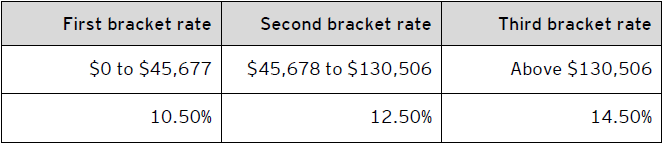

The 2021 Saskatchewan personal tax rates are summarized in Table B.

Table B – 2021 Saskatchewan personal tax rates

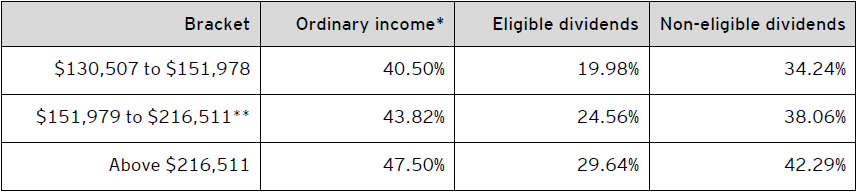

For taxable income in excess of $130,506, the 2021 combined federal-Saskatchewan personal income tax rates are outlined in Table C.

Table C – Combined 2021 federal and Saskatchewan personal tax rates

* The rate on capital gains is one-half the ordinary income tax rate.

** The federal basic personal amount comprises two elements: the base amount ($12,421 for 2021) and an additional amount ($1,387 for 2021). The additional amount is reduced for individuals with net income in excess of $151,978 and is fully eliminated for individuals with net income in excess of $216,511. Consequently, the additional amount is clawed back on net income in excess of $151,978 until the additional tax credit of $208 is eliminated; this results in additional federal income tax (e.g., 0.32% on ordinary income) on net income between $151,979 and $216,511.

Personal tax credits

This budget proposes changes to the following personal credits/amounts:

- The budget confirms the introduction of the Saskatchewan Home Renovation Tax Credit, which provides a 2021 tax credit on eligible home renovation expenses up to $11,000 incurred between 1 October 2020 and 31 December 2021 and a 2022 tax credit on eligible expenses up to $9,000 incurred between 1 January 2022 and 31 December 2022. In each year, there is a $1,000 threshold before expenses are eligible for the tax credit.

- The budget reintroduces the Active Families Benefit, which provides a refundable tax credit up to $150 per child (increased to $200 for a child with a disability) on registration costs for cultural, recreational and sports activities. The credit is only available to families with a combined net income of $60,000 or less and is retroactively effective on 1 January 2021.

Other tax measures

Saskatchewan Technology Start-up Incentive

The budget extends the Saskatchewan Technology Start-up Incentive for five years through to 2025–26. This incentive provides a non-refundable 45% income tax credit for individual, corporate or venture capital corporation investments in eligible start-up businesses. The budget also extends the carry-forward period to claim unused tax credits from four years to seven years.

Natural gas taxation

The budget introduces a moratorium on royalties on natural gas associated with oil production by implementing a royalty rate of 0% for a period of five years commencing on 1 April 2021 and ending on 31 March 2026.

Oil taxation

The budget expands the High Water-Cut Program (HWCP) for a period of five years commencing on 1 April 2021 and ending on 31 March 2026. The HWCP reduces the royalty rate for eligible oil wells up to 2%.

Sodium sulphate taxation

The budget introduces a simplified system for sodium sulphate royalties by replacing the scaled production-based royalty with a 3% flat royalty rate, effective retroactively on 6 April 2020.

The budget introduces a credit for 10% of qualifying capital expenditures eligible for use against sodium sulphate royalties otherwise payable, effective retroactively on 6 April 2020.

Vapour product taxation

The budget introduces a Vapour Products Tax of 20% on the retail price of all vapour liquids, products and devices, effective on 1 September 2021.

Heat-non-burn tobacco product taxation

The budget introduces a tax rate on heat-non-burn tobacco sticks of 20.5¢ per stick, effective on 1 June 2021.

Electric vehicle taxation

The budget introduces an annual tax of $150 per passenger electric vehicle registered in Saskatchewan, effective for registrations beginning on 1 October 2021. This tax will be collected by Saskatchewan Government Insurance.

Property tax

The budget introduces increases to the Education Property Tax mill rates in line with year-over-year inflation.

Learn more

For more information, please contact your EY or EY Law advisor or one of the following professionals:

Ryan Ball

+1 306 649 8225 | ryan.ball@ca.ey.com

Craig Hermann

+1 306 649 8204 | craig.hermann@ca.ey.com

Wes Unger

+1 306 649 8247 | wes.unger@ca.ey.com

Luke Hergott

+1 306 649 8251 | luke.hergott@ca.ey.com

Download this tax alert

Budget information: For up-to-date information on the federal, provincial and territorial budgets, visit ey.com/ca/Budget.